Half-year results: China rises as Western sales drop back | Despite the country’s stock market crash last summer, Artprice.com have named China ‘the world’s largest art marketplace’ in a new study. This comes in a week that, as widely reported, Chinese insurer Taikang has amassed a 13.5 per cent stake in Sotheby’s, making it the dominant shareholder. (Chen Dongsheng, the grandson-in-law of former Chinese leader Mao Zedong and Taikang’s CEO and chairman, is also founder and president of the China Guardian auction house as well as deputy chairman of the China Auction Association.)

Through analysis of first half 2016 auction results, Artprice deduced China accounted for $2.32 billion (35.5 per cent) of the estimated $6.53 billion global sales turnover (including fees). China’s return to pole position is almost entirely due to big sales in Hong Kong which, says Artprice, is ‘the only major marketplace in the world that has continued to post market growth (up 10 per cent) and it is clearly keeping the Chinese art market alive.’

Indeed Sotheby’s Asia record season high total was down to Hong Kong sales such as that of the Pilkington Collection of Chinese ceramics and Zhang Daqian’s Peach Blossom Spring ($34.7 million). Sotheby’s Asia sales rose 22 per cent to HK$3.6 billion/US$461.5 million (full results will be released later this month).

Peach Blossom Spring (1982), Zhang Daqian. Courtesy Sotheby’s

The 18 per cent turnover growth for China defies reports of slowdown in the country and is set against contraction in the West, with New York down 49 per cent and London down 30 per cent. While transactions rose 3.2 per cent worldwide, sales turnover dropped by a quarter, ‘almost entirely due to a reduced offer of major masterpieces (works priced over $10 million) in all artistic periods’.

But, the study also stresses ‘the heart of the Western art market appears to have retained its vitality’ with a stable, relatively low 28 per cent unsold rate. In layman’s terms, more has sold for less money. This was evident in Christie’s 27 per cent fall in first half sales, from £2.9 billion ($4.5 billion) to £2.1 billion ($3 billion) for the first half of 2016 compared to the same period last year. Volume of lots sold for under £1m rose, while works of art selling above £20m at auction dropped. This year, 29 lots sold for over £5 million versus 47 lots in the first half of 2015. Sotheby’s full results will likely reflect a similar drop in top end consignments and, inevitably, commentators are asking if this is a market slump.

Old Masters of the Old Masters on the move | Plates are shifting in the slow-moving world of London’s Old Master galleries. Today Derek Johns closes his gallery at 12 Duke Street, St James’s, after more than 30 years. This may mark the end of an era, but on 5 September Johns will open again 100m away, in Flat 27 Georgian House, 10 Bury Street.

‘I blame it all on our interfering nanny state’, says Johns. He and Philip Harari used to own the freehold of number 12 in their joint pension fund, but when Harari retired in the 1980s, he wanted to extract his share. Johns was not allowed to buy him out by the government pension fund trustees, therefore had no choice but to sell and lease back. ‘Then tempus fugit, and Fabrizio Moretti managed to buy both Johnny van Haeften’s building and mine with an eye for redevelopment.’ Moretti Fine Art has secured planning permission from Westminster Council to knock the two buildings into a single art gallery.

Although initially depressed, Johns is now excited by the move: ‘Good always comes out of change… Everyone who has seen [Georgian House] prefers it to the small stack of 18th-century rooms on five floors at number 12.’ Johns’ neighbour Johnny van Haeften will move from 13 Duke Street at the end of December, after 35 years, to work from his Richmond home. There he will concentrate on the ‘ABC’ of advising, brokering and consulting, ‘with a bit of D because I can’t quite give up dealing’.

Beatrix Potter at 150 | Yesterday (28 July) marked the 150th anniversary of the birth of author and illustrator Beatrix Potter. Cue a flurry of Potter’s drawings and books coming to market and, on the big day itself, an anniversary sale at Dreweatts & Bloomsbury devoted to Potter’s books and works on paper. Nearly 100 pieces came from the collection of Lake District resident John Cawood, a Potter fan since childhood, who started collecting in 1972.

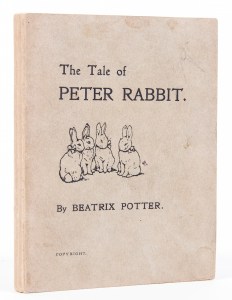

First edition of The Tale of Peter Rabbit by Beatrix Potter. Dreweatts & Bloomsbury, London

Peter Rabbit, of course, led the sale; a first edition of The Tale of Peter Rabbit, given by the author to her goddaughter, Helen Burton, and one of only 250 copies from the first printing, sold for £43,400 (estimate: £25,000–£35,000). It’s far from a Potter record though; that is still held by a previously unseen watercolour of rabbits leaving a Christmas party, sold for £289,500 at Sotheby’s in 2008.

The Leslie Waddington Collection | The art trade has retreated to the Langeudoc with a chilled rosé, but auction houses are already drip-feeding news of their October Frieze Week sales in London. A highlight is Christie’s single owner sale on 4 October of the collection of the late Leslie Waddington (1934–2015), a maverick London art dealer in the late 20th century.

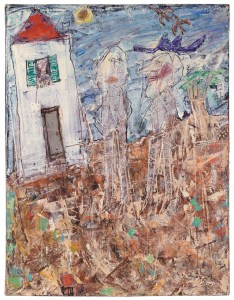

Visiteur au chapeau bleu avril (1955), Jean Dubuffet. Waddington Collection at Christie’s London

Waddington once said that ‘A good painting, like good music or good literature, always has to question you.’ So prepare for interrogation from his collection of 20th-century and contemporary art, by the likes of Josef Albers, Alexander Calder, Milton Avery, Agnes Martin, Francis Picabia, and Jean Dubuffet.

Unlimited access from just $16 every 3 months

Subscribe to get unlimited and exclusive access to the top art stories, interviews and exhibition reviews.

![Masterpiece [Re]discovery 2022. Photo: Ben Fisher Photography, courtesy of Masterpiece London](http://www.apollo-magazine.com/wp-content/uploads/2022/07/MPL2022_4263.jpg)

It’s time for the government of London to return to its rightful home