Corporate art collections and their lofty ambitions of stakeholder engagement, social responsibility and creative innovation look increasingly fragile in the current crisis. The writing seemed to be on the wall in June as British Airways (BA) revealed that it was selling works from its collection through Sotheby’s. At the time, the bulk of the airline’s fleet was grounded and management had plans to cut its workforce by up to 30 per cent. Perhaps selling some of its art was the least it could do.

The message couldn’t have been more different from when BA began shouting about its collection back in 2008. As the airline launched operations in the newly built Terminal 5 at Heathrow airport, its art credentials and commissioning plans contributed to its rebranding as a contemporary, creative business. Buzzwords included ‘staff engagement’, ‘education’ and ‘investment in the community’, as noted by Charlotte Appleyard and James Salzmann in their book Corporate Art Collections (2012). Angeline Mayhead, who for almost 20 years headed up the airline’s lounge development, explains in the same book that ‘art is an increasingly valuable asset, which enlivens lounge interiors and embodies the [British Airways] brand and its values’. She described the collection at that time as ‘enduring and sustainable’.

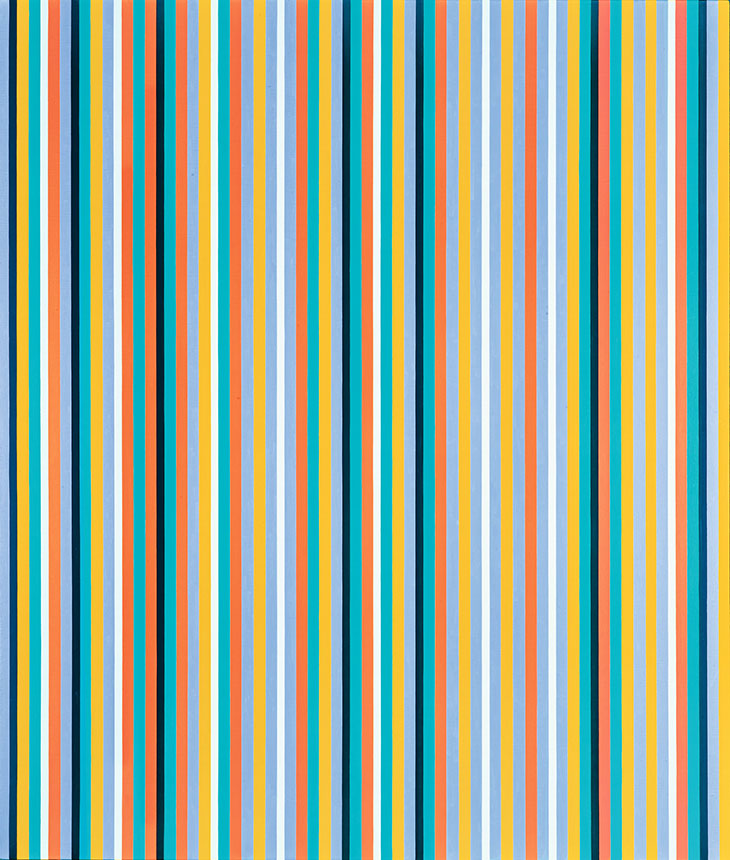

At least until the next downturn, that is. The 17 works offered this year were a very small part of BA’s 1,500-piece collection but included a prize painting – Bridget Riley’s acclaimed Cool Edge (1982). Having latterly hung in BA’s first-class lounge at Heathrow, it sold this July for £1.9m, including fees. In total, BA’s works went for £2.2m against a pre-sale estimate of £920,000–£1.4m.

Cool Edge (1982), Bridget Riley. Sotheby’s, £1,875,000

Such values don’t come close to covering BA’s losses – its parent company IAG has seen its share price plummet since March and reported a second quarter loss of more than €2bn. Similarly, the various sales of works from the collection of the once-vaunted private equity company Abraaj Investment Management, whose parent company filed for provisional liquidation in 2018, barely scratch the surface of its shortfall. But the new message is loud and clear. When it comes to the crunch, art is just another asset on a corporation’s balance sheet.

In truth, the trajectory of corporate collecting had already shifted. Many of the most active buyers were banks, notably Deutsche Bank and UBS, who embraced the tradition that David Rockefeller began at Chase Manhattan in 1959. Deutsche boasts a 60,000-piece collection amassed since 1979; UBS has around 30,000 works. Come the financial crash of 2008, banking buyers seemed quickly to take a back seat as individual wealth began to dominate the ever-inflating art market. Sponsorship proved a more powerful play – and seemed win-win. It was a great way to entertain a bank’s clients, who hopefully then bought some art themselves, while fairs such as Frieze (main sponsor Deutsche Bank) and Art Basel (UBS) secured around a third of their income in this way.

Selling art from a collection was still frowned upon, but it did happen. UBS once ran what was described as a ‘self-funding model’, namely selling works that no longer met its collecting requirements in order to buy other pieces. In 2010, and to benefit charities, Germany’s Commerzbank sold Alberto Giacometti’s bronze L’Homme qui marche I (cast in 1961) for an astonishing £65m. As the (then) most expensive work to sell at auction, this must still be food for thought for businesses during an economic crisis.

Corporates themselves have changed considerably too. Leadership is less about a post-war, authoritative vision of one man (yes, it was generally a man). Ideals are now moving towards a more collaborative and transparent style of management. Amassing an art collection is increasingly perceived as less sustainable or meaningful than supporting artists and grassroots initiatives more directly. In the best cases, both interests are served – the restaurant chain Nando’s runs programmes to develop and support emerging artists, mostly in southern Africa, and then buys and displays their work around the world. It currently has a growing collection of 22,000 pieces.

Meanwhile, corporate philanthropy and its ultimate goals are also increasingly scrutinised. Gilding misdeeds (real or perceived) with shiny museum sponsorship, art prizes or an art collection no longer washes easily with public opinion. In a similar vein, buying pricey paintings while making staff redundant is probably not the best advised public relations strategy.

Then there’s the other reality ushered in by Covid: that the buildings, offices, restaurants, art fairs and airline lounges where corporations display their art are themselves threatened. There’s not much point in a multinational bank dedicating each of its meeting rooms to a different artist now that meetings happen from home via Microsoft Teams.

The optimistic believe that alternative and collaborative patronage models are finding a way through the current crisis, and it seems unlikely that corporate support will disappear overnight. But its historic social and economic benefits seem to have run dry. Expect more sales in this complicated third decade of the 21st century.

From the October 2020 issue of Apollo. Preview and subscribe here.

Lead image: used under Creative Commons licence (CC BY-SA 4.0)

Have corporate art collections had their day?

Photo: QuentusPetillius/Wikimedia Commons

Share

Corporate art collections and their lofty ambitions of stakeholder engagement, social responsibility and creative innovation look increasingly fragile in the current crisis. The writing seemed to be on the wall in June as British Airways (BA) revealed that it was selling works from its collection through Sotheby’s. At the time, the bulk of the airline’s fleet was grounded and management had plans to cut its workforce by up to 30 per cent. Perhaps selling some of its art was the least it could do.

The message couldn’t have been more different from when BA began shouting about its collection back in 2008. As the airline launched operations in the newly built Terminal 5 at Heathrow airport, its art credentials and commissioning plans contributed to its rebranding as a contemporary, creative business. Buzzwords included ‘staff engagement’, ‘education’ and ‘investment in the community’, as noted by Charlotte Appleyard and James Salzmann in their book Corporate Art Collections (2012). Angeline Mayhead, who for almost 20 years headed up the airline’s lounge development, explains in the same book that ‘art is an increasingly valuable asset, which enlivens lounge interiors and embodies the [British Airways] brand and its values’. She described the collection at that time as ‘enduring and sustainable’.

At least until the next downturn, that is. The 17 works offered this year were a very small part of BA’s 1,500-piece collection but included a prize painting – Bridget Riley’s acclaimed Cool Edge (1982). Having latterly hung in BA’s first-class lounge at Heathrow, it sold this July for £1.9m, including fees. In total, BA’s works went for £2.2m against a pre-sale estimate of £920,000–£1.4m.

Cool Edge (1982), Bridget Riley. Sotheby’s, £1,875,000

Such values don’t come close to covering BA’s losses – its parent company IAG has seen its share price plummet since March and reported a second quarter loss of more than €2bn. Similarly, the various sales of works from the collection of the once-vaunted private equity company Abraaj Investment Management, whose parent company filed for provisional liquidation in 2018, barely scratch the surface of its shortfall. But the new message is loud and clear. When it comes to the crunch, art is just another asset on a corporation’s balance sheet.

In truth, the trajectory of corporate collecting had already shifted. Many of the most active buyers were banks, notably Deutsche Bank and UBS, who embraced the tradition that David Rockefeller began at Chase Manhattan in 1959. Deutsche boasts a 60,000-piece collection amassed since 1979; UBS has around 30,000 works. Come the financial crash of 2008, banking buyers seemed quickly to take a back seat as individual wealth began to dominate the ever-inflating art market. Sponsorship proved a more powerful play – and seemed win-win. It was a great way to entertain a bank’s clients, who hopefully then bought some art themselves, while fairs such as Frieze (main sponsor Deutsche Bank) and Art Basel (UBS) secured around a third of their income in this way.

Selling art from a collection was still frowned upon, but it did happen. UBS once ran what was described as a ‘self-funding model’, namely selling works that no longer met its collecting requirements in order to buy other pieces. In 2010, and to benefit charities, Germany’s Commerzbank sold Alberto Giacometti’s bronze L’Homme qui marche I (cast in 1961) for an astonishing £65m. As the (then) most expensive work to sell at auction, this must still be food for thought for businesses during an economic crisis.

Corporates themselves have changed considerably too. Leadership is less about a post-war, authoritative vision of one man (yes, it was generally a man). Ideals are now moving towards a more collaborative and transparent style of management. Amassing an art collection is increasingly perceived as less sustainable or meaningful than supporting artists and grassroots initiatives more directly. In the best cases, both interests are served – the restaurant chain Nando’s runs programmes to develop and support emerging artists, mostly in southern Africa, and then buys and displays their work around the world. It currently has a growing collection of 22,000 pieces.

Meanwhile, corporate philanthropy and its ultimate goals are also increasingly scrutinised. Gilding misdeeds (real or perceived) with shiny museum sponsorship, art prizes or an art collection no longer washes easily with public opinion. In a similar vein, buying pricey paintings while making staff redundant is probably not the best advised public relations strategy.

Then there’s the other reality ushered in by Covid: that the buildings, offices, restaurants, art fairs and airline lounges where corporations display their art are themselves threatened. There’s not much point in a multinational bank dedicating each of its meeting rooms to a different artist now that meetings happen from home via Microsoft Teams.

The optimistic believe that alternative and collaborative patronage models are finding a way through the current crisis, and it seems unlikely that corporate support will disappear overnight. But its historic social and economic benefits seem to have run dry. Expect more sales in this complicated third decade of the 21st century.

From the October 2020 issue of Apollo. Preview and subscribe here.

Lead image: used under Creative Commons licence (CC BY-SA 4.0)

Unlimited access from just $16 every 3 months

Subscribe to get unlimited and exclusive access to the top art stories, interviews and exhibition reviews.

Share

Recommended for you

A museum of Islamic art in Jerusalem is selling works to make ends meet

The museum is selling part of its collection of Islamic art as well as some extraordinary timepieces

Is e-commerce the future for museum shops?

With far fewer in-person visitors exiting through the gift shop, institutions must find new ways to mitigate their losses

‘Setting people against objects makes for a grim discussion’

Museums face difficult financial choices, but there has to be a better way forward than the pitting of staff against permanent collections