From the November 2022 issue of Apollo. Preview and subscribe here.

Robert Pattinson, teen-heart-throb-turned-arthouse-actor, is better known for his chiselled cheekbones than his curatorial chops. That didn’t stop Sotheby’s hiring him as ‘guest curator’ of the latest in its Contemporary Curated series of sales in New York at the end of September. But stunts like these now lift few eyebrows in the art trade. Sotheby’s success in co-opting celebrities such as rapper and producer Skepta, DJ Swizz Beatz and singer-songwriter Ellie Goulding to boost their marketing efforts is becoming the norm.

What has caused greater debate is what might seem to the outside observer a minor detail of the sale. The latest Contemporary Curated featured six works labelled ‘Artist’s Choice’. This is an initiative designed to encourage living artists to sell new work at auction, with the agreement of their commercial galleries. The plan, according to Noah Horowitz, Sotheby’s head of gallery and private dealer services and the former Americas director of Art Basel, is to include ‘Artist’s Choice’ works in several sales in Europe, Asia and the United States next year. For some in the trade, this is an interesting experiment because works sold at auction are usually second-hand, consigned by the collectors (or their descendants) who originally bought them. For others, it represents a potential landgrab by the mighty auction houses into the increasingly contested turf of art galleries.

What has raised the stakes is that the ‘Artist’s Choice’ works in the sale did exceptionally well – despite the fact that none of the artists are household names. The six works were estimated at a total of $255,000 to $360,000: the sale, including buyer’s premium, made $919,800. A sculpture by Brooklyn artist Kennedy Yanko, supplied by veteran New York gallerist Jeffrey Deitch, made more than double its high estimate selling at $176,400, while a painting by Atsushi Kaga, supplied by mother’s tankstation (Dublin/London), went for $201,600, five times its high estimate.

Artists consigning their work directly to auction rather than selling through their commercial galleries is not entirely new. In China, where commercial galleries are still developing, it is fairly common. In Korea, Seoul Auction has a series for artists selling direct to auction that does not have the protection of a reserve – the lowest minimum figure for a winning bid. In more established art markets the most famous example is ‘Beautiful Inside My Head Forever’: the sale that took place in London in 2008, when Damien Hirst consigned 223 new works to Sotheby’s (the degree of involvement of his galleries White Cube and Gagosian was never made clear). The event was as much an artwork in itself as an auction. Hirst has repeatedly used what Artforum critic Jack Bankowsky has called ‘the mechanisms of the art machine’ as his ‘medium, much like paint or marble’. Despite its huge financial success, few people thought it was a model that other artists would want to or be able to copy.

Set Aflame and Warm (2022), Kennedy Yanko. Sotheby’s New York, Contemporary Curated (September 2022), $176,400 (est. $60,000–$80,000). Photo: Martin Parsekian

Who sells what and how may seem a mere technicality to anyone not directly involved in marketing art. Most serious collectors buy from both galleries and auctions. But at times the gulf between what is often called the primary and secondary markets can be wide.

Galleries that represent living artists are the primary market: their role is to manage their artists’ careers, placing works with collectors and with museums most likely to burnish their (and by extension the galleries’) reputations long-term. They like to see prices rise steadily and restrict who can buy, especially as artists become successful.

Traditionally they dislike their artist’s work appearing at auction, preferring owners to resell the work through them privately. Not only are these private sales a lucrative part of their business, poor public auction results can be damaging even for an artist doing well. Deep-pocketed galleries may bid at auction to prevent this happening, especially now that auction price databases make public auction results easily accessible.

Auctions houses, meanwhile, are in the secondary market: they represent owners who consign works for sales. Their main interest is to get the highest price possible on a particular day and they have little interest in living artists’ long-term careers.

Veteran auctioneer Simon de Pury remembers a charity auction of works donated by artists he was asked to host back in the 1990s in his native city of Basel when he was at Sotheby’s. It was designed to benefit a cash-strapped Kunsthalle Basel – the favourite hangout of collectors, journalists, artists and galleries during Art Basel. ‘There was such a howl of protest from the galleries and the fair [even for a charity auction] that the Kunsthalle felt it had to withdraw,’ he recalls. ‘In the end we went ahead selling certificates authorised by the artists for hot air. It was great fun and we made a lot of money.’ A lot more, in fact, than the sale of the real works of art some time later, when the fair and international galleries had departed.

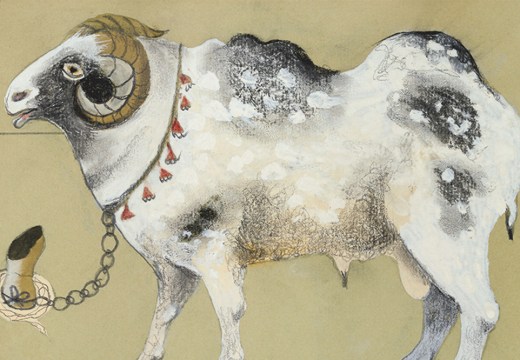

This has not stopped auction houses revisiting the idea of working with living artists. Last year Robin Woodhead, a former chairman of Sotheby’s, ran two online auctions of works consigned by artists under the banner ‘The Stand’. De Pury launched his own artist-and-gallery auction platform at the end of August – an online exhibition and auction, conducted live, with an avatar of the famous auctioneer as the MC. Titled ‘Women – Art in Times of Chaos’ it set records for artists including African American quilter Phyllis Stephens and ink painter Minjung Kim. In both cases, the auctions were sweetened by a charitable element – a small percentage of the hammer price going to good causes – a model Horowitz has adopted for ‘Artist’s Choice’.

The Life of the Kitten with Brown Ears (2022), Atsushi Kaga. Sotheby’s New York, Contemporary Curated (September 2022), $201,600 (est. $30,000–$40,000) Photo: courtesy the artist and mother’s tankstation Dublin/London

Why this is happening is simple: competition. Up until the 1990s, contemporary art was a small, risky and difficult-to-understand section of the art world and the big auction houses were happy to largely leave it to the primary galleries. But the boom in international demand for contemporary art, which has led to the explosion in contemporary biennials and museums in the past 30 years, brought that separation to an end. Now, art made since 1945 represents a third of Sotheby’s and Christie’s sales and is their single largest category. Phillips, a house founded in 1796 and which once sold paintings from the estate of Marie Antoinette, now focuses almost solely on postwar and contemporary art, design, photography, jewellery and watches.

Meanwhile, despite the reported influx of younger buyers, especially from Asia, the art market has not really grown for a decade. The most reliable estimates put overall market size at around $65bn, the same as it was in 2011. Auction income has also remained flat once adjusted for inflation, at just under $17bn. Competition for market share remains fierce, and not just among the auction houses. Last month, Marc Glimcher, the president and chief executive of Pace Gallery, told Apollo that competition between major galleries was ‘toxic’.

Auction houses have encroached into galleries’ traditional business in the past, most notably since the 1990s in selling secondary works privately – capitalising on the advantage that they know the identities of the under-bidders, or losing bidders, on all the works in their public sales. It has proved highly lucrative: in 2021, Sotheby’s reported $1.3bn and Christie’s $1.7bn in private sales.

According to De Pury, it was the rise in private sales that prompted him to set up his artist-and-gallery auction platform. ‘It always surprised me that the big galleries didn’t start doing their own auctions, since auctions were venturing into private treaty sales. The galleries know their clients just as well as the auction houses, and more so in the contemporary market,’ he says. ‘I was struck by the fact whenever there is an emerging artist with strong demand, and let’s say there are only 15 works for a gallery to strategically place. Every single time one of those lucky people turns around and goes to one of the three auction houses [Sotheby’s, Christie’s, Phillips] and puts it up for sale. You get a huge price spike and the only beneficiaries are the seller and the auction house.’

It seems that at least some galleries agree. Almine Rech, who has galleries in Paris, London, New York, Brussels and Shanghai, consigned works by artists including Amanda Wall, Minjung Kim and Haley Josephs to De Pury’s auction and a work by Vaughn Spann to ‘Artist’s Choice’. Rech says that although the gallery asks buyers not to resell within three years ‘there are always some people who try to flip after a year or two. We put a big moral and financial investment, especially into emerging artists, and then we are facing all this speculation around their work. This way we and the artists make money, instead of the person who sells.’ Meanwhile, when so many newer collectors check auction data, some galleries may find a high public price for a less-well-known artist is no bad thing.

Pieno di Vuoto (2020), Minjung Kim. De Pury, Women – Art in Times of Chaos (August 2022), $85,000 (est. $80,000–120,000). Photo: Courtesy the artist and Almine Rech Gallery

Not all auction incursions into the gallery space have worked long-term, however. In 2007, at the height of the last contemporary art market boom, Christie’s bought trendy gallery Haunch of Venison, that had spaces in London, Berlin and New York. Because of its ownership, the gallery was frozen out by Frieze and Art Basel, two of the top contemporary fairs. The venture limped along until 2013. Earlier this year, Artnet News reported that 147 works by contemporary British artists with a Haunch of Venison provenance were discreetly sold off at the end of 2021 ‘at below-market prices’ through regional British auctioneer Bellmans.

In 2016, Sotheby’s bought art advisory Art Agency, Partners with a view to increasing private sales. The investment worked, but plans to expand AAP to represent artist’s estates – classic gallery turf – were quietly shelved. More recently, Sotheby’s partnered with galleries on its ‘Buy-Now’ online platform, but after a launch with high-profile galleries including Karma, König and Lévy Gorvy, works from only four mid-tier galleries are currently for sale.

‘“Women – Art in Times of Chaos” was more difficult to put together than I expected,’ admits De Pury, saying galleries were ‘a little nervous’. Thanks to the strong results, he is now planning his next auction for early next year. ‘There’s a built-in thing saying that the two sides of the art market are the enemy, but that’s ridiculous. Both sides need each other, and behind the scenes there’s a lot of collaboration going on,’ he says.

The theory has always been that auction works best for artists who are most well-known: with long careers, recognisable work, plenty on show in museums and solid sales records. In 2021, the top selling artists at auction were Picasso, Basquiat and Warhol; the top living artists were the 80-something superstars Gerhard Richter and Yayoi Kusama.

By contrast, the artists in ‘Artist’s Choice’ and De Pury’s ‘Women’ auction had hardly any name recognition. The sales’ success relied on the organisers knowing which emerging artists have hot insider markets – and then succeeding in securing the work. It might explain the decidedly average performance of six fresh-to-market works by African American artists selected by Baltimore-based Galerie Myrtis placed in Christie’s ‘Post-War to Present’ sale the day before Sotheby’s Contemporary Curated. Most living artists are not, after all, in high demand. So perhaps contemporary galleries have little to fear – much like artists at the top end of the market, public auction doesn’t really work for the many, just the few.

From the November 2022 issue of Apollo. Preview and subscribe here.

Unlimited access from just $16 every 3 months

Subscribe to get unlimited and exclusive access to the top art stories, interviews and exhibition reviews.

![Masterpiece [Re]discovery 2022. Photo: Ben Fisher Photography, courtesy of Masterpiece London](http://www.apollo-magazine.com/wp-content/uploads/2022/07/MPL2022_4263.jpg)

It’s time for the government of London to return to its rightful home